Multifamily 2017 Outlook: Positioned for Further Growth

Multifamily 2017 Outlook: Positioned for Further Growth

The multifamily market has enjoyed several years of rapid growth and seems poised to continue to grow in 2017, although at a more moderate pace.

- Slow-but-steady economic growth continued in 2016, which supported strong demand for multifamily rental units. Despite high levels of construction permits and starts, vacancy rates remained flat, while strong demand pushed up rents and gross-income growth above the historical norm.

- A greater amount of new supply will be delivered to the market in 2017 but most of it will be absorbed, given continued economic growth and strong multifamily fundamentals. Vacancy rates will increase slightly, but still leave room for rent and gross-income growth.

- The top 10 list of fastest-growing metropolitan areas will see some jockeying for position in 2017, with smaller, more affordable markets making a showing.

_________________________________________________________________________________________

2016 in Review: Another Strong Performance

The multifamily market continued its above-average performance in 2016, in line with most expectations but with some surprises at the metro level. New supply entering the market kept pace with demand as vacancy rates remained flat over the year, as reported by REIS. While expectations for vacancy rates to increase in 2016 did not come to fruition, anticipated moderation in rent growth did take place. Despite the moderation, rent growth remained above the historical average in 2016. Several of the larger metro areas experienced more pronounced slowing than the broader market, such as San Francisco and New York City. Although most metros saw rent growth moderation in the past year, the majority continued to perform above their pre-recession averages.

Economic growth continued to support strong multifamily fundamentals. The labor market improved in 2016 but progress was slower than in previous years. The economy added 2.2 million jobs in 2016 – more than the historical average, but considerably fewer than the 3 million and 2.7 million jobs added in 2014 and 2015, respectively. The labor force participation rate was 62.7 percent as of December 2016, which is only marginally higher than a year prior and lower than the post-recession average of 63.6 percent.

With oil prices tumbling in the beginning of 2016, down to $27 per barrel, and a strong dollar keeping U.S.

exports suppressed, employment tied to these sectors, as well as areas of the country that rely heavily on these industries, saw slower growth throughout 2016. The manufacturing sector contracted in 2016 with a growth rate of -0.4 percent. Since May 2016, oil prices have been between $40-$50 per barrel, indicating that prices may finally be stabilizing. Fortunately, not all sectors experienced such poor performance; construction slowed in 2016 but still recorded annual growth of 1.6 percent. Education and health services along with professional and business services grew the most with year-over-year increases of 2.7 percent and 2.6 percent, respectively.

Average hourly earnings rose 2.9 percent over the past year – the largest annual gain since 2008. The strengthening wage growth is a welcome sign by many since it’s the last major piece of the labor market to recover. Meanwhile, the unemployment rate continued its downward trend. It ended the year at 4.7 percent, down 30 basis points (bps) from the prior year but up from the cyclical low of 4.6 percent in November 2016. Overall, the Federal Reserve judged the labor market to be healthy and cited the recent employment gains as justification for a federal funds rate increase this past December.

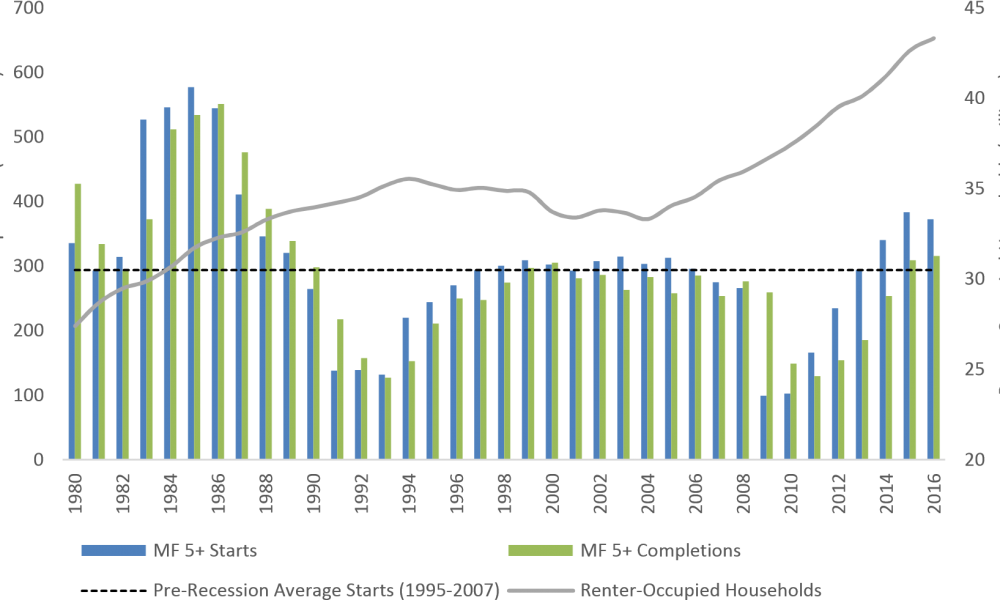

Strong labor markets encouraged more household formations in 2016, as shown in Exhibit 1. Through the third quarter, 1.2 million new households were formed– more than the post-recession average of 850,000 per year. Of them, a larger share – 630,000 – rented their homes, keeping demand for rental units at historical highs, largely due to demographic shifts and lifestyle preferences. But the 590,000 new owner-occupied households represent the largest year-over-year gain in 10 years. The homeownership rate at the end of the third quarter of 2016 was 63.5 percent, down 20 bps from the prior year but up 60 bps from the prior quarter. Exhibit 1: Multifamily Starts and Completions (5+ Units) and Renter Households

Sources: Freddie Mac, U.S. Census Bureau, Moody’s Analytics

To keep up with the rise in renter households, multifamily construction has reached the highest levels since the late 1980s, when tax-code changes spurred the market. Shown in Exhibit 1, multifamily permits and starts have stopped – or paused – their upward trajectory. Permits dropped around 13 percent over the year while starts were down 3 percent. Multifamily completions nudged slightly higher in 2016 – up to 315,000 units delivered in the year, an increase of 2 percent from 2015. While the number of new deliveries is high from a historical perspective, it falls short of expectations, given that multifamily starts have been at or above 300,000 since 2013. Reasons include construction delays because of weather or skilled-labor shortages. In addition, some delays were planned so that delivery would occur during more favorable seasonal or competitive conditions.

Construction can stay at these levels as demand fuels development. The slowing of construction permits and starts in 2016, however, is a sign that the market is not overheated and developers are adjusting plans responsibly.

Demand kept pace with supply, holding vacancy rates relatively flat over the past year. With more competition entering the market, rent growth moderated in 2016 from the cyclical peaks of 2015 but remained above the historical average. Rent growth was softer at the high end of the rent spectrum in several markets that saw an explosion of new, luxury inventory, namely New York City, San Francisco, and San Jose. Rent growth in these areas will remain suppressed but only temporarily as new supply is absorbed and rent growth reverts back to its long-run averages.

2017: “Moderation” Is the Word

The multifamily market will continue to grow in line with the historical average in 2017. Employment growth is expected to remain near 2016 growth levels and demand for multifamily units to stay strong due to lifestyle preferences and demographic trends. At a national level, multifamily completions are expected to be higher in 2017 than in 2016 but will continue to enter the market at a disciplined rate. As a result, vacancy rates will increase modestly in 2017 and are expected to breach 5 percent for the first time since 2011, although remain below the historical average.

To read more of this article visit http://www.freddiemac.com/multifamily/pdf/mf_2017_outlook.pdf