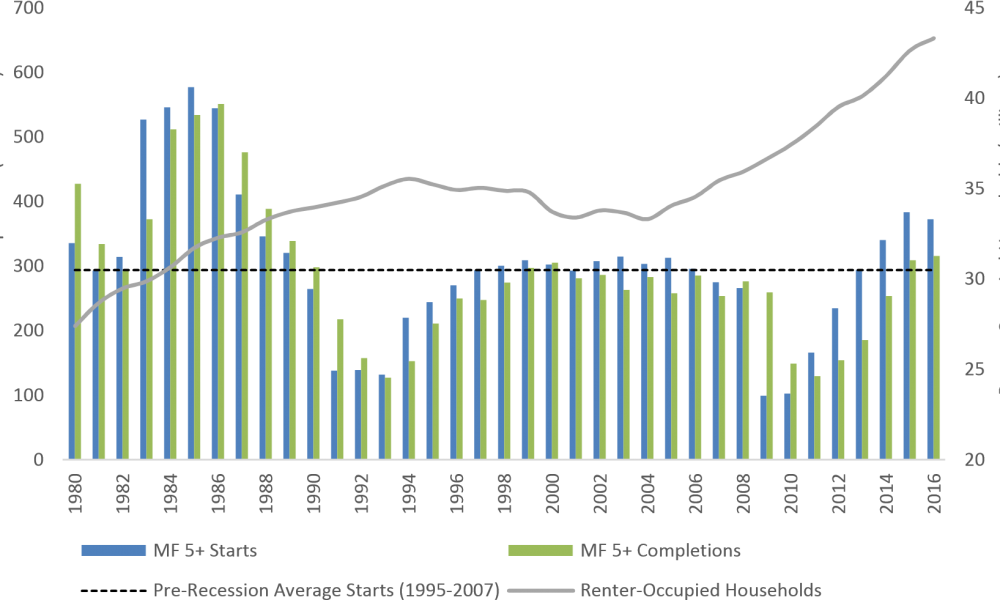

Various real estate entities have weighed in with their prognostications for the 2017 housing market. Most observers expect home sales and prices to moderate in the coming year. They say suburbs will make a comeback while the days of low mortgage rates are over.

Of course, a lot depends on the actions of the new administration. Although President-elect Donald Trump said little about housing during the campaign, some of the issues he highlighted will have an effect on the residential real estate market, such as infrastructure spending, regulatory and tax reform, and immigration policies.

[Mortgage rates move higher for the seventh week in a row]

Below is a roundup of what the experts say buyers, sellers and renters can expect in 2017:

Realtor.com predicts “a year of slowing, yet moderate growth.” The listing service for the National Association of Realtors compiled five housing trends for 2017:

Millennials and boomers will dominate the market. Realtor.com expects these two massive demographic groups to power demand for the next decade.

Midwestern cities will continue to be hotbeds for millennials. According to Realtor.com, millennials are clamoring to live in Madison, Wis.; Columbus, Ohio; Omaha; Des Moines; and Minneapolis.

Slowing price appreciation. Realtor.com forecasts home prices will grow at Continue Reading